Are you having an ‘out of money’ experience?

Are you having an ‘out of money’ experience?

If so, chances are that it’s due to your habits, attitude and a real ‘tug of war’ inside you.

We all have desires, dreams and beliefs that pull us towards achieving the goals we have in life right? But sometimes we start to make progress on our goals and then suddenly something happens to sabotage it; either our thoughts, willpower, beliefs and even unknown forces that stop us cold in our tracks. What is going on, we know we want the outcome, so what is happening?

Our minds are very powerful and they can prevent us from reaching those dreams no matter how badly we want to change our experiences, improve who we are, or have more money. Truth is we are not consciously in control. Our subconscious mind is mightier than our goals, beliefs and passion and even our actions. When it says; ‘No’ we then feel stuck, wishing and hoping for a change and when it doesn’t come we settle for mediocrity and the status quo… “Oh well, I guess it wasn’t meant to be.”

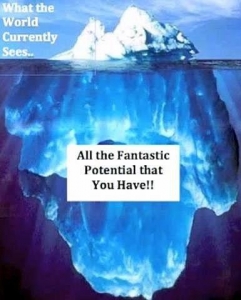

In this picture of an iceberg you can see that 90% is hidden beneath the surface of the water while only 10% is visible. Now I didn’t make this stuff up; Neuro scientists and others have determined that the human brain operates in much the same way.

In this picture of an iceberg you can see that 90% is hidden beneath the surface of the water while only 10% is visible. Now I didn’t make this stuff up; Neuro scientists and others have determined that the human brain operates in much the same way.

As far as your ‘Money Mindset’ goes the 10% above the water represents how much money we make, how much savings we have, how much we have invested, how much debt we have and our current status.

The 90% below is what created the 10%; which can be all that pent up, pushed down and unexpressed emotional charge around money; basically your money stories and beliefs. It is what drives our financial decisions; our Actions and Inactions. It is also the home of our unlimited potential!

This massive block of emotion (mindset) includes all our social and emotional conditioning around money; money paradigms we’ve inherited from our parents, media, family, or religion. It also is the result of of our supportive and non-supportive values and principles. Ultimately this is where the buck stops and our results are shaped.

Our money beliefs and stories (remember which are loaded with emotion!) are the triggers that play out in the 10%. Boring traditional financial planning advice drives me crazy! Spend less, earn more and save more; if that was so easy, then why is it that some have all the advice and are still coming up short? As a financial advisor for over 19 years I saw it all the time. It’s why I left a big corporation and started my own money coaching business 11 years ago. This is it people, the missing piece of money success; your mindset.

I see too many people that are stuck with a mindset that it will be too hard and so they are afraid to get into action. Let this be your wake up call to start having more fun! Money equals fun; as in living your dreams.

We generally don’t want to do anything if it is not fun so lighten up and not take it so serious that there is no fun in getting there. When I work with my clients my number one rule is to have fun! Oh and one other…stop settling for less than what you really want. If you take the action, uncover the blocks and create new stories, you will be on your way! Your mindset is a wonderful fun place to play and the results you create will be what you really want; not what you settle for.

We generally don’t want to do anything if it is not fun so lighten up and not take it so serious that there is no fun in getting there. When I work with my clients my number one rule is to have fun! Oh and one other…stop settling for less than what you really want. If you take the action, uncover the blocks and create new stories, you will be on your way! Your mindset is a wonderful fun place to play and the results you create will be what you really want; not what you settle for.

If you want some of my ‘mindset’ magic then click HERE – lets shake things up and have some fun!

Cheers